Forex day trading is one of the most widely attempted forms of active trading, drawing both beginners attracted by the market’s accessibility and professionals who treat currencies as the most liquid playground in finance. The foreign exchange market operates continuously during the business week, with liquidity following the globe from Sydney to Tokyo, London to New York. For day traders, this constant motion creates opportunities in short bursts, often concentrated around economic releases, session overlaps, and unexpected news headlines.

This article takes a long-form approach to the subject, breaking down the structure of the forex market, the instruments most suitable for day trading, how liquidity and volatility behave across sessions, the role of execution and costs, the strategies traders employ, and the risks—both financial and psychological—that shape outcomes. The goal is not to provide a “secret” method but to give a clear framework for understanding where forex day trading fits as a discipline and what it demands of those who attempt it.

If you can not find the answer to your question in this article then I recommend you visit DayTradingForex.com.

The Nature of the Forex Market

Unlike equities or futures, forex is not centralized on a single exchange. Instead, it functions as an over-the-counter market, with a network of banks, brokers, and liquidity providers quoting prices electronically. This decentralized structure creates both advantages and complications. The advantage is global reach and continuous trading. The complication is that the quality of prices and execution depends on which broker and liquidity providers a trader connects to.

Daily turnover in forex exceeds six trillion dollars, with the vast majority concentrated in a handful of major currency pairs. This liquidity makes it possible for traders to enter and exit quickly, even with significant size. At the same time, liquidity is not constant throughout the day. It ebbs and flows as different regions come online, and price behavior changes with those shifts.

Trading Sessions and Liquidity Profiles

Asian Session

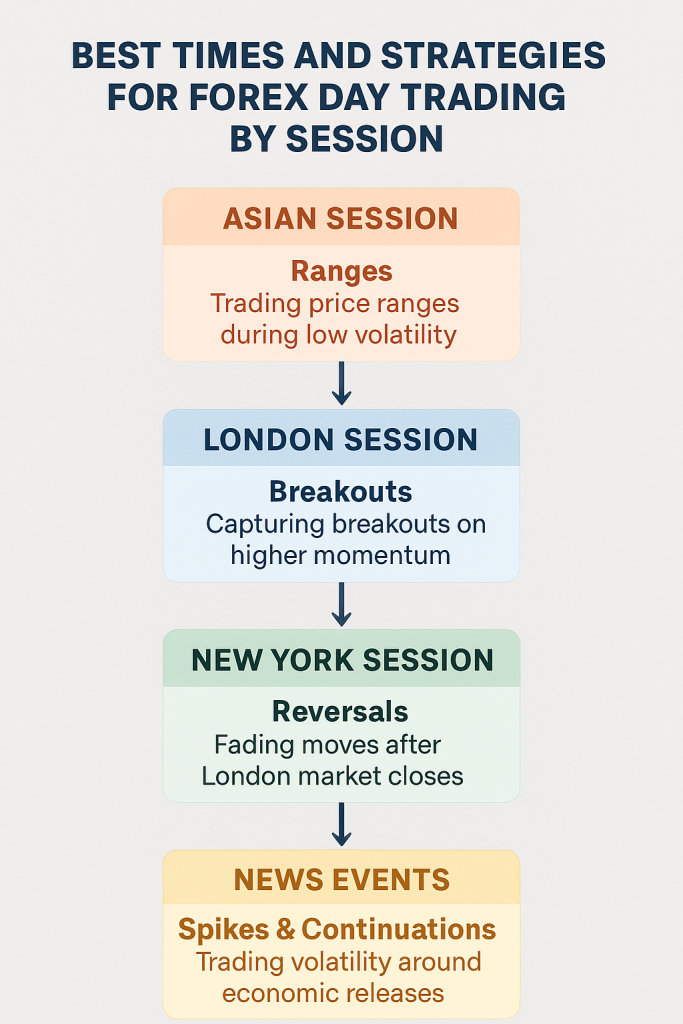

The Asian session begins with Sydney and Tokyo. Liquidity is thinner than in Europe or North America, spreads are wider, and volatility is generally lower. Price action often consolidates during these hours, making it attractive for traders who prefer range-bound strategies or scalping in calm conditions. The yen and Australian dollar pairs see the most activity. News from the Bank of Japan, Reserve Bank of Australia, or Chinese data can spark volatility, but these are isolated events.

Asian Session Case Study: Tokyo Range Play

The Asian session often carries a reputation for low volatility, particularly compared to Europe or North America. Yet within this quiet environment lies a pattern many traders exploit: the establishment of intraday ranges.

Scenario: USD/JPY during the Tokyo morning, after a calm overnight move. Price consolidates between 147.40 and 147.70, with no significant economic releases scheduled. The Bank of Japan is not expected to intervene, and broader risk sentiment is stable.

Approach: A mean reversion strategy works best. Traders identify the established range and fade moves to its extremes, entering short near 147.70 with stops just above 147.85, and going long near 147.40 with stops just under 147.25. Profit targets are set near the middle of the range or just shy of the opposite boundary.

Outcome: Over three hours, the pair oscillates between 147.40 and 147.70 multiple times. A disciplined trader, using smaller position sizes to reflect the session’s lower volatility, can capture 10–15 pips per swing without significant drawdown.

Lesson: The Asian session rewards patience and risk control. Attempting breakouts in thin liquidity often results in false moves, while range strategies exploit the session’s stability.

European Session

London dominates forex volume. As European banks and institutions become active, liquidity deepens, spreads tighten, and volatility rises. Breakouts are more likely to succeed, momentum trades have cleaner follow-through, and news-driven moves gather strength. The European session sets the tone for much of the trading day, especially in EUR, GBP, and CHF pairs.

European Session Case Study: London Breakout

London is the beating heart of forex trading. Volume surges as European institutions open their books, and overnight ranges often break decisively.

Scenario: EUR/USD after the Asian range of 1.0810 to 1.0830. London opens with German PMI data due, a release that can influence euro sentiment.

Approach: Traders mark the Asian range and wait for London participants to provide direction. A breakout strategy is placed: a buy stop at 1.0835 and a sell stop at 1.0805, both with tight stops of around 10 pips. Risk per trade is capped at one percent of account equity.

Outcome: PMI prints stronger than expected, and EUR/USD surges through 1.0835. The breakout order triggers, and momentum carries price to 1.0870 before slowing. The trader exits at 1.0865 for a 30-pip gain, three times the initial stop.

Lesson: The London session transforms overnight ranges into directional moves. Breakout strategies are more reliable here than in Asia, provided risk is defined and traders avoid entering too early.

US Session

When New York joins London, the market reaches peak liquidity. This overlap is the most active window of the day. Major US economic data releases, Federal Reserve commentary, and broader global news can drive sustained trends. Volatility can be sharp, but spreads usually remain tight due to the heavy participation of institutions and algorithmic trading. After London closes, liquidity gradually tapers, leaving New York to carry the market into the afternoon.

US Session Case Study: New York Reversal

The overlap between London and New York creates the most active trading window of the day, but once London closes, momentum often fades. This shift frequently produces reversals.

Scenario: GBP/USD rallies strongly during London, rising from 1.2620 to 1.2720 by midday. As New York takes over, no major US data is scheduled, and UK traders begin closing positions.

Approach: Traders watch for signs of exhaustion: slowing momentum, rejection at 1.2720, and lower highs on shorter timeframes. A short entry is taken at 1.2710 with a stop above 1.2730, targeting a retracement to 1.2660.

Outcome: As London closes, GBP/USD drifts lower, eventually hitting 1.2660 by mid-afternoon in New York. The trade produces 50 pips against 20 pips of risk.

Lesson: Intraday reversals are common when liquidity shifts from one region to another. New York traders often fade London moves unless reinforced by new data or headlines.

Currency Pairs and Day Trading Characteristics

The most suitable pairs for day trading are the majors: EUR/USD, USD/JPY, GBP/USD, and USD/CHF. They trade with the tightest spreads, deepest order books, and most consistent volatility. Commodity-linked pairs such as AUD/USD, NZD/USD, and USD/CAD provide additional movement but are more sensitive to external markets like commodities.

Crosses such as EUR/GBP or AUD/JPY can be attractive when specific themes drive them, but their liquidity is thinner and spreads wider, making them less ideal for scalping. Exotic pairs, while volatile, are typically unsuited for intraday trading due to high transaction costs and erratic price jumps.

Execution and Cost Structure

Day trading in forex depends on execution quality. Since profits are often measured in small increments, the difference between a one-pip spread and a three-pip spread can be significant. Most brokers offer variable spreads that tighten in active hours and widen when liquidity thins.

Slippage is another factor. In fast-moving conditions, orders may be filled at worse prices than intended. This is particularly common during major economic releases. Traders must decide whether to trade during news events, where volatility can create opportunity but execution risk is highest.

Leverage is both a benefit and a hazard. Forex brokers often offer high leverage, sometimes exceeding 100:1. While this allows meaningful exposure on small accounts, it also magnifies losses. A single adverse move can wipe out an account if risk is not controlled. Professional traders typically use leverage conservatively, focusing on position sizing rather than trying to maximize exposure.

Day Trading Strategies in Forex

Scalping

Scalping targets small, frequent profits by entering and exiting within seconds or minutes. It requires ultra-fast execution, stable connections, and a broker with tight spreads. Scalpers rely heavily on technical analysis, focusing on order flow, support and resistance, and short-term momentum.

Breakout Trading

Breakouts occur when price moves beyond established support or resistance levels. These often align with session opens or major news events. Successful breakout trading requires distinguishing genuine momentum from false moves, which are common in forex due to liquidity hunts and stop runs.

Mean Reversion

During quieter hours, particularly in Asia, forex pairs often revert to average ranges. Traders employ oscillators, moving averages, or Bollinger Bands to identify stretched conditions and fade moves. The risk is getting caught when a quiet session transforms into a trending one after an unexpected headline.

News and Event Trading

Economic calendars provide predictable catalysts. Non-farm payrolls, inflation reports, central bank announcements, and GDP releases can drive sharp moves. News trading strategies vary: some traders position in advance, others wait for the initial volatility spike and attempt to catch the continuation. Execution risk is high, and slippage is unavoidable at times.

News Event Case Study: Non-Farm Payrolls

Major data releases create extreme volatility. The monthly US non-farm payrolls (NFP) report is one of the most anticipated, often producing sharp whipsaws.

Scenario: USD/JPY ahead of NFP, trading quietly at 149.20. Consensus expects 200k jobs, but the actual figure prints at 280k, signaling stronger-than-expected US labor conditions.

Approach: Experienced traders avoid trying to predict the number. Instead, they wait for the first spike to settle and look for continuation. The report drives USD/JPY to 149.90 in seconds, then retraces to 149.40. Once price holds above 149.50, a long entry is taken, with stops below 149.30 and a target near 150.20.

Outcome: Momentum carries USD/JPY higher, and the target is reached within 20 minutes. Traders who tried to straddle both directions with orders often found themselves stopped out by the initial whipsaw.

Lesson: News events reward patience and confirmation. Waiting for the first spike and pullback often provides a safer entry than attempting to catch the initial move.

Technical and Fundamental Inputs

Day trading in forex is primarily technical, but ignoring fundamentals is a mistake. Scheduled data drives volatility, and central bank policy provides context. A trader ignoring a Bank of England rate decision while trading GBP/USD is gambling blind.

Technical tools include support and resistance zones, moving averages, Fibonacci retracements, oscillators like RSI or stochastic, and candlestick formations. Volume is less reliable in forex due to its decentralized nature, so traders often substitute price action analysis for volume confirmation.

Risk Management in Forex Day Trading

The defining factor in forex day trading success is risk management. Traders must decide in advance where they are wrong and place stops accordingly. Many losses come not from strategy failure but from removing stops or increasing size to chase losses.

Common practices include limiting each trade to a fixed percentage of account equity, setting a daily stop-loss to prevent emotional spirals, and adjusting position size based on volatility. For example, a wider stop in GBP/USD around a news release should be paired with a smaller position than a tight stop during quiet Asian ranges.

Case Studies of Market Events

The Swiss Franc Shock, 2015

When the Swiss National Bank abandoned the euro peg, EUR/CHF collapsed by nearly 30 percent in minutes. Day traders caught on the wrong side saw stops skipped, accounts wiped out, and in some cases, negative balances. This event illustrated that leverage and reliance on tight stops can be catastrophic in extreme volatility.

Brexit Referendum, 2016

GBP pairs experienced unprecedented intraday swings as referendum results came in. Spreads widened, liquidity disappeared at times, and prices moved hundreds of pips in minutes. Traders with disciplined risk controls survived; those overleveraged were eliminated.

COVID-19 Volatility, 2020

In March 2020, forex markets experienced record volatility as global uncertainty surged. USD became the safe-haven currency, driving historic moves across pairs. Traders who adapted by reducing size and widening stops found opportunity; those who traded as if conditions were normal faced ruin.

Psychological Demands

Forex day trading is accessible but psychologically punishing. The 24-hour nature of the market tempts traders to overtrade, chasing movement in every session. Discipline to sit out low-probability times is as valuable as execution skill. Emotional resilience matters because intraday volatility often produces drawdowns before profits. Many strategies rely on statistical edges that require dozens or hundreds of trades to manifest, meaning losses are part of the process.

Comparing Forex with Other Day Trading Markets

| Market | Liquidity | Volatility | Costs | Halts/Gaps | Accessibility | Style Fit |

|---|---|---|---|---|---|---|

| Forex | Extremely high in majors | Moderate with bursts | Low spreads, swap costs | Rare, but news gaps | Global, 24/5 | Scalping, breakout, reversion |

| Stocks | High in large caps | High at open, event-driven | Commissions, slippage | Frequent halts/gaps | US session only | Momentum, news-driven |

| Futures | Very high in index contracts | Moderate, trending | Exchange + commissions | Exchange limits | Session-based | Structured, technical |

| Options | Concentrated in indices | Driven by vol + price | Wider spreads, fees | Underlying halts impact | Limited liquidity in many strikes | Volatility trading |

| CFDs | Broker-dependent | Varies by asset | Spread + financing | No exchange, but provider rules | Accessible worldwide | Convenience-focused |

This article was last updated on: August 25, 2025